Originally posted by Premium Parrots

NEW YORK (Reuters) - Gold futures fell more than $100 on Wednesday, one of the steepest falls ever, as strong U.S. economic data and expectations of more Federal Reserve stimulus accelerated profit taking from the safe-haven record high of a day ago.

Selling spiraled out of control as money managers competed to liquidate positions in COMEX futures, which experienced their biggest single-day dollar loss since 1980. Volume looked like a record.

The price of gold bullion is now more than $150 below Tuesday's all time high of $1,911.46 an ounce, downed by intense speculation about whether the Fed will announce new plans to ease monetary policy at a meeting late this week.

Analysts said it was time for gold investors to take money off the table after the rally extended too far, too fast in recent weeks. Bullion rose as much as $400 since July.

"You have a commodity that retail investors, hedge funds and everybody were long, and the technical indicators showed it was overbought. It was just a matter of time before the market starts cracking," said Mihir Dange, COMEX gold options floor trader for Arbitrage LLC.

Spot gold was down 4.1 percent to $1,754.59 an ounce by 3:37 p.m. EDT, off its session low of $1,749.39.

Before gold began recoiling Tuesday from above $1,900, it had risen nearly 9 percent over six sessions.

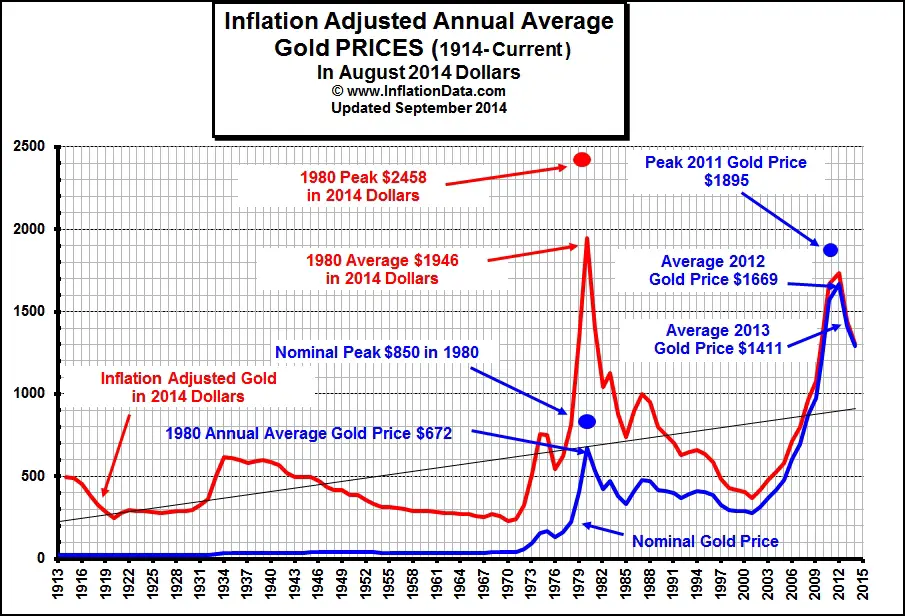

U.S. gold futures for December delivery settled down $104 at $1,757.30 an ounce. Reuters data showed that is the biggest price drop of the continuous, front-month contract since January 22, 1980, when it tumbled almost $150. On a percentage basis, it was the steepest fall since December 2008, during the financial crisis.

COMEX futures volume topped 430,000 lots, on pace to surpass a record from August 9, preliminary Reuters data showed.

Silver dropped 5.9 percent to $39.34 an ounce.

Gold came under pressure after steadying overnight, after a report showing new orders for U.S. durable goods orders rose 4 percent in July, more than expected and offering hope the ailing economy could dodge a second recession.

Analysts warned of a sharp correction from this month's rally was possible, especially if Friday's central bank meeting at Jackson Hole, Wyoming does not result in a Fed announcement of a third round of government bond buying, or quantitative easing, also known as QE3.

MORE

Is this really only a correction in the market ........ or the beginning of further drastic plunges??

Leave a comment: